What Do Dread Disease Policies Cover

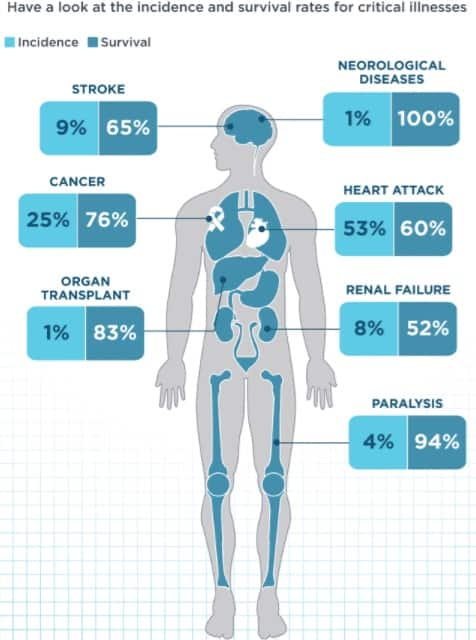

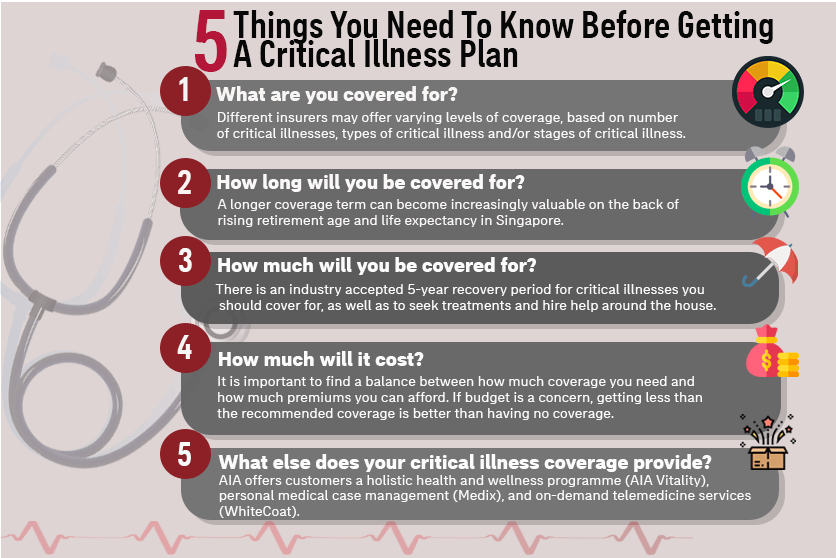

What do dread disease policies cover. A dread disease policy which is also known as a critical illness policy is a type of insurance policy that pays out a tax-free lump sum in the event that you fall ill with one of the major illnesses diseases or events that the policy covers. A dread disease also called a critical illness is severe. Your critical illness cover covers you for illnesses such as cancer cardiovascular and heart disease stroke and organ failure as well as a range of neurological and gastroenterological conditions.

Like any insurance the exact scope of the policy can differ greatly depending on the provider or level of. Critical Illness Cover offers financial protection against illnesses such as a heart attack cancer stroke Alzheimers and Parkinsons disease. The Comprehensive Dread Disease benefit covers cancer myocardial infarction heart valve surgery valvotomy by endoscopic procedures aortic artery surgery.

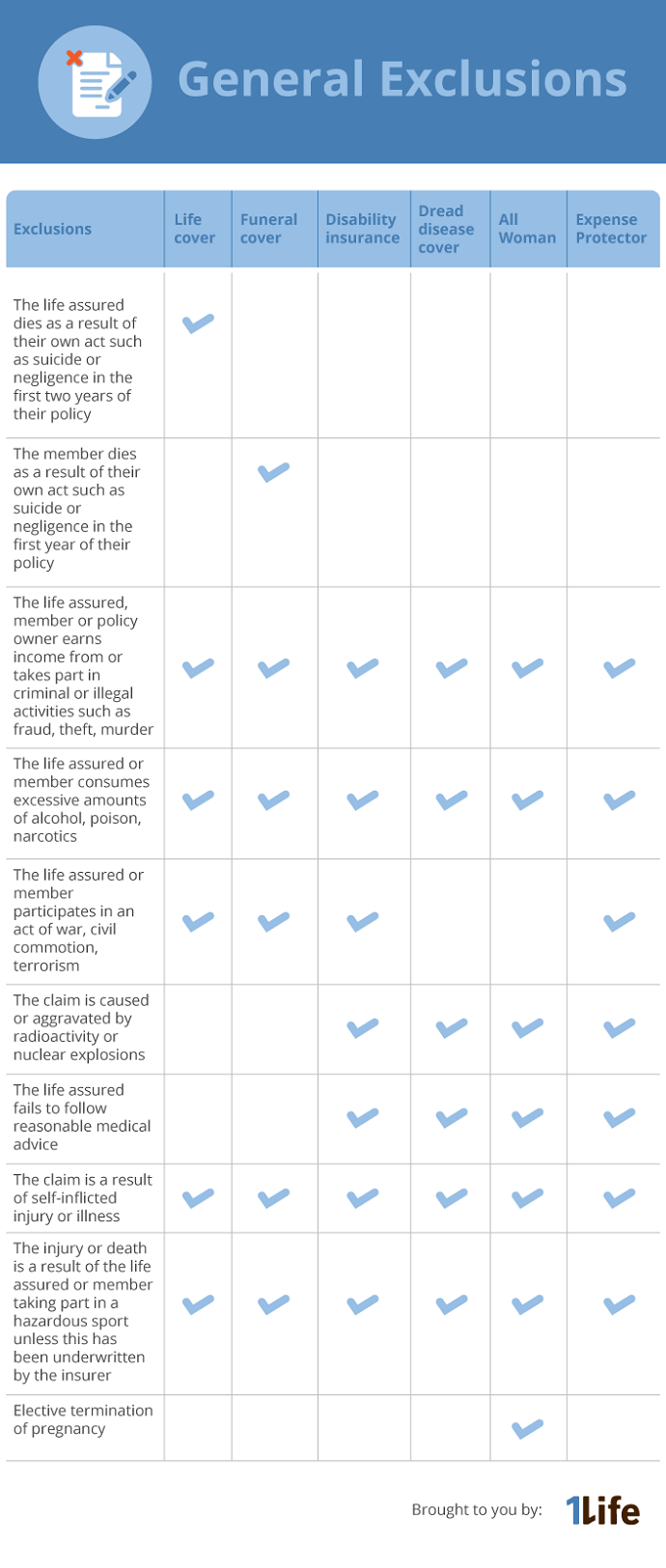

This is an accelerated benefit which means that a members death benefit Group Life Assurance Benefit is. Most dread disease cover policies cover cancer stroke heart attacks and coronary bypass graft surgery which are regarded as the Big 4 when it. Do you need disability insurance or dreaded disease insurance.

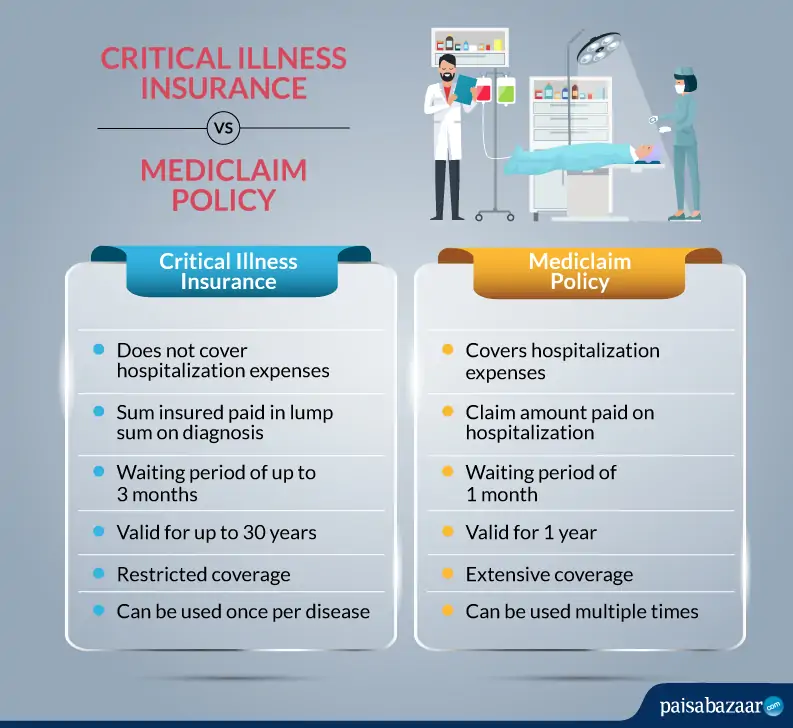

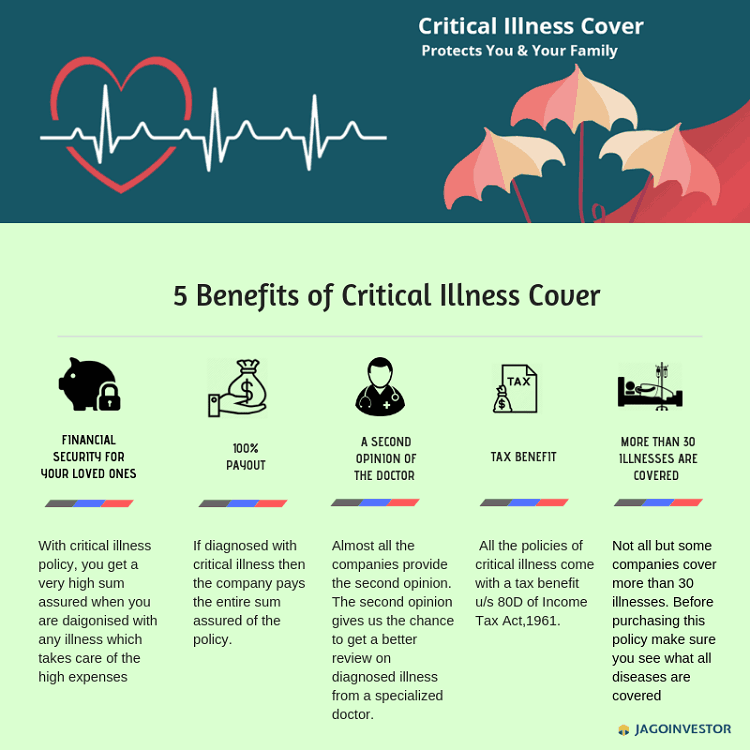

Dread Disease Cover benefits. It can also supplement reduced incomes when the illness is so debilitating that a career change or even stopping work is required and in some cases the benefit assists with experiences like a holiday to help ease the emotional impact of the disease. Even if you are able to work dread disease still pays you out as opposed to disability that covers your finances when you are unable to be at work.

Dread disease cover generally pays out a tax free lump sum whereas disability cover pays you a lump sum on a monthly basis. Convincing a prospective insured to buy an insurance policy based on exaggerations is called. Up to R10 million in life cover depending on your personal circumstances.

What is covered by a dread disease policy. Other life insurance company also uses the same definition although some wordings might vary. Most policy holder who bought the common 36 critical illnesses coverage also known as 36 dread diseases will have the definition clearly stated in their life insurance policy.

Upon reaching the limiting age a handicapped child can extend their health insurance coverage as a dependent. No premium increases within the first 24 months.

Most dread disease cover policies cover cancer stroke heart attacks and coronary bypass graft surgery which are regarded as the Big 4 when it.

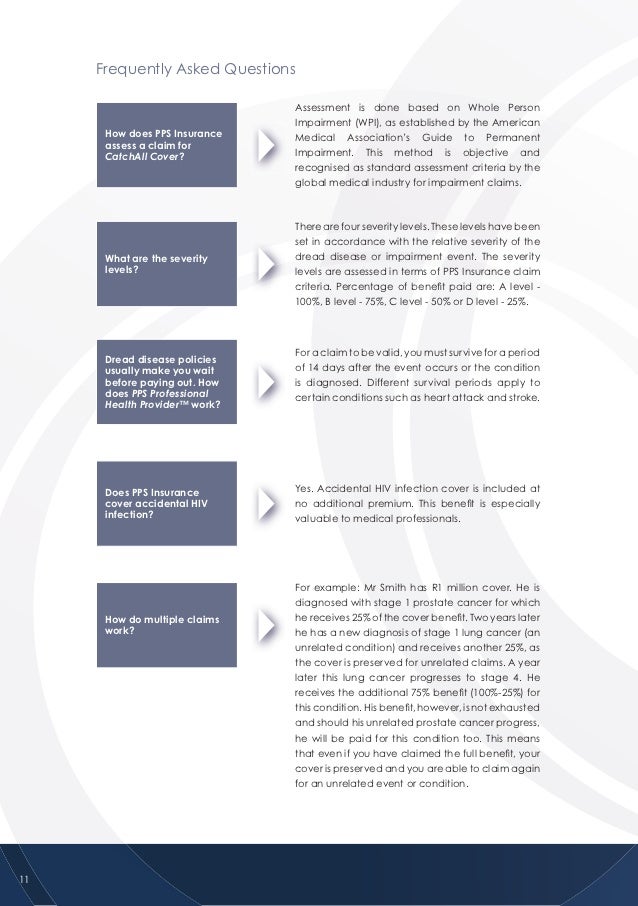

Here is the definition taken from Great Eastern Life insurance policy. Your critical illness cover covers you for illnesses such as cancer cardiovascular and heart disease stroke and organ failure as well as a range of neurological and gastroenterological conditions. Blindness permanent and irreversible. Accelerated dread disease for the spouse Covers children for all listed critical illnesses Catch-all benefit pays 100 for any serious condition that Alexander Forbes Life considers being as severe as a listed condition. Dread disease cover is an insurance benefit that offers a lump sum tax-free payment in the event that you are diagnosed with a severe illness. Dread disease cover generally pays out a tax free lump sum whereas disability cover pays you a lump sum on a monthly basis. The Comprehensive Dread Disease benefit covers cancer myocardial infarction heart valve surgery valvotomy by endoscopic procedures aortic artery surgery. Dread disease cover also known as critical illness cover is an insurance product in which the insurer is contracted to typically make a lump sum cash payment if the policyholder is diagnosed with one of the specific illnesses on a predetermined list as part of an insurance policy. A dread disease also called a critical illness is severe.

A dread disease also called a critical illness is severe. Here is the definition taken from Great Eastern Life insurance policy. Critical Illness Cover offers financial protection against illnesses such as a heart attack cancer stroke Alzheimers and Parkinsons disease. Almost all policies cover cancer stroke and heart attack with some also paying out in the event that you require open heart surgery. A specific disease or illness All diseases or illnesses Only terminal illnesses Only heart-related diseases. Blindness permanent and irreversible. Dread disease cover also known as critical illness cover is an insurance product in which the insurer is contracted to typically make a lump sum cash payment if the policyholder is diagnosed with one of the specific illnesses on a predetermined list as part of an insurance policy.

/GettyImages-1046447804-7beb075e44a34852986cd92b2117afc4.jpg)

:max_bytes(150000):strip_icc()/covid19-e98789dc810147c6b1e82180a904d02d.jpg)

:max_bytes(150000):strip_icc()/Aflac1-7a460fa8f4ed49d789e229fb2b82fc51.jpg)

Hi, nice information is given in this blog. Thanks for sharing this type of information; it is so useful for me. Nice work keeps it up.

ReplyDeleteTo get more information about medical insurance, visit our website.

<a href="https://www.prudential.com.sg/products/wealth-accumulation/>Investment Plan</a>

Very engaging information you shared, liked the way you presented it , learn more about banking have a look at Best Savings Account

ReplyDelete